Debt settlement is a common issue that affects countless individuals and businesses. It occurs when someone is unable to pay off their debts. This leaves them with a large balance and mounting interest charges. For companies that specialize in debt settlement, having a steady stream of debt leads is crucial for staying afloat. That’s where debt settlement live transfers and pillar content marketing come in.

Traditional marketing tactics like cold-calling and direct mail may have been effective in the past, but the age of media has changed. Today, businesses must adapt to new digital marketing strategies that deliver better results. Pillar content marketing is one such strategy that can help generate leads for debt settlement companies.

But what exactly is pillar content marketing, and how can it help generate debt settlement leads?

In this blog, we’ll explore the benefits of pillar content marketing and how it can help your business thrive in the digital age.

We’ll also dive into debt settlement live transfers, another effective lead generation strategy, and how to combine the two for maximum results.

So buckle up, and get ready to discover the secrets of generating debt settlement leads with pillar content marketing!

You May Also Like: How to Generate Leads for Your Small Business?

What is Debt Settlement Live Transfer?

Picture this: you’re struggling with a mountain of debt and feeling overwhelmed. Suddenly, your phone rings and a friendly voice on the other end offers to help you settle your debts. That’s the power of debt settlement live transfer!

Basically, debt settlement live transfer is a fancy way of saying that debt settlement companies can connect with you directly and transfer you to a live representative. This person can help you navigate the murky waters of debt settlement.

Unlike pillar content marketing, which is all about creating great content to attract potential clients, debt settlement live transfer is more like having a personal debt settlement assistant right at your fingertips.

Elevating Debt Settlement Quality through Live Transfers

So how does it work? Well, debt settlement companies use call centers or debt lead generation companies to find people like you who may be interested in their services. Once they find someone, they’ll give you a call. Then, ask if you’d like to speak to a live representative who can help you settle your debts.

If you say yes (which you probably will!), they’ll transfer you to a friendly representative who can answer all your questions and offer personalized solutions to help you get back on track.

Additionally, one of the best things about debt settlement live transfer is that it allows debt settlement companies to quickly connect with people who are actively seeking debt relief. That means that the leads generated through debt settlement live transfer are typically high quality and more likely to turn into paying customers.

Plus, speaking to a live representative can get immediate feedback and build trust with the company. It’s like having a personal cheerleader who wants to see you succeed!

In short, if you’re feeling overwhelmed by debt, debt settlement live transfer can be a lifeline. By leveraging this powerful marketing strategy, debt settlement companies can quickly connect with potential clients and build long-term relationships that benefit everyone involved.

So if you’re ready to start your debt-free journey, just pick up the phone and connect with a friendly representative who’s ready to help you settle your debts!

Read More: How to Generate Leads for Your Small Business?

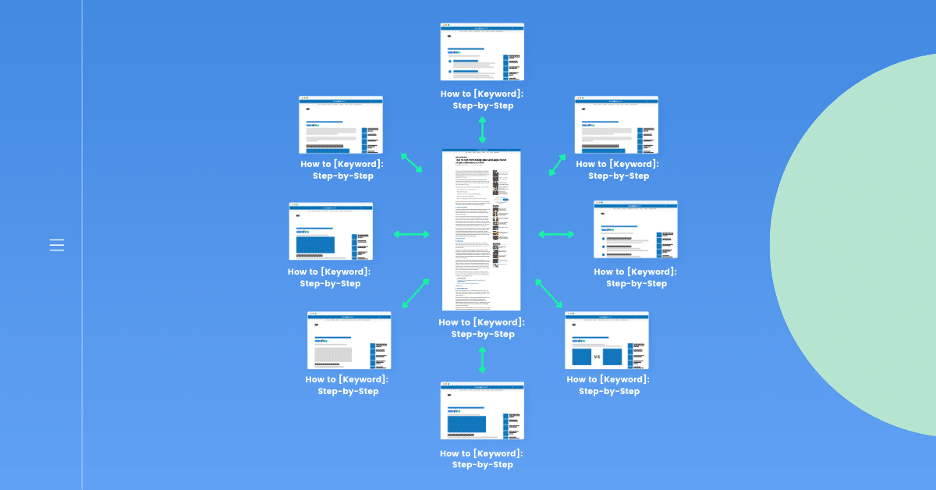

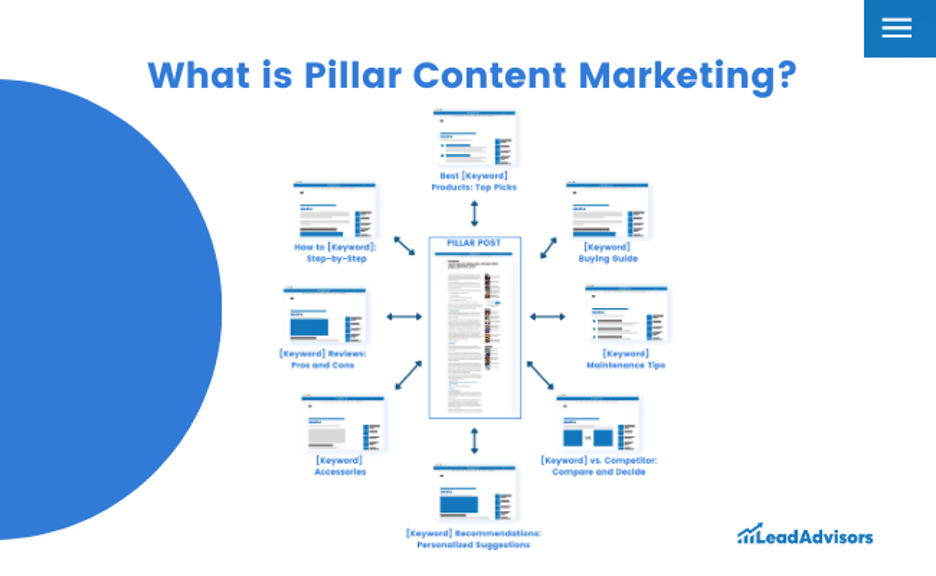

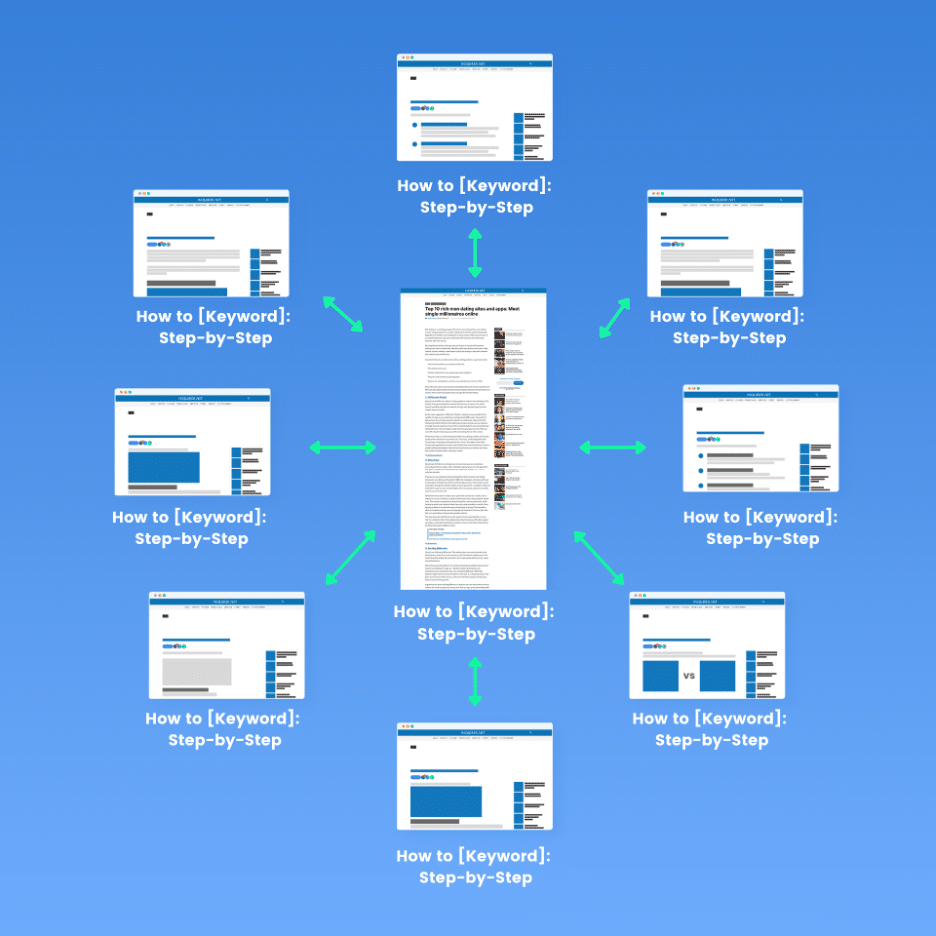

What is Pillar Content Marketing?

Alright, let’s talk about pillar content marketing – one of the coolest and most effective ways to generate leads for your debt settlement business!

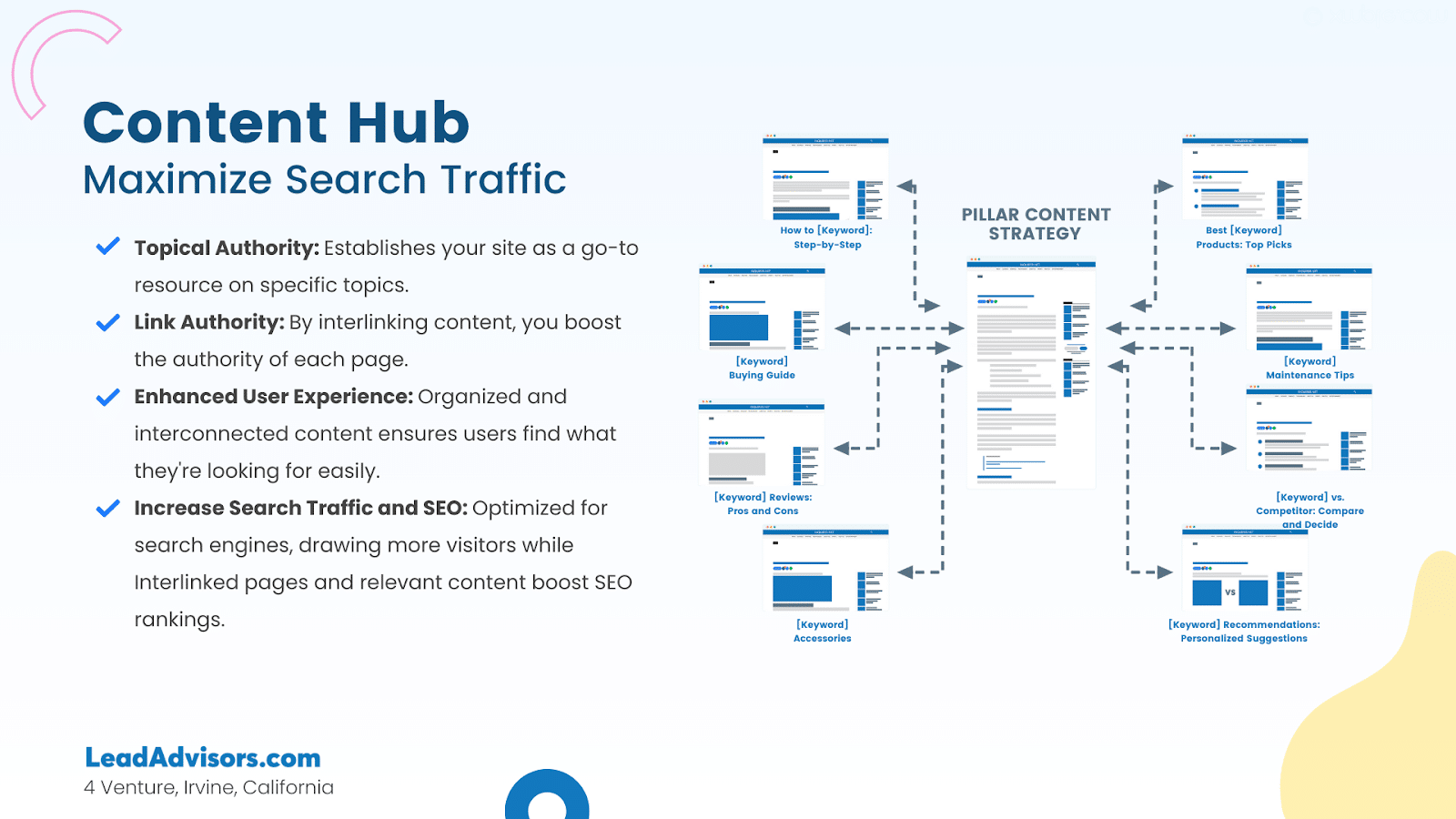

Instead of just throwing out random blog posts or articles, pillar content is about creating high-quality, informative, and engaging content covering a broad topic area. Altogether, this means going deep and providing a comprehensive overview of a particular subject, which can take the form of long-form articles, videos, infographics, or even e-books.

But why bother with all of this effort? Because the goal of pillar content marketing is to establish your business as an authority in the debt settlement industry.

By creating a valuable resource that your target audience will want to return to time and time again, you build trust and credibility with them. And let’s face it – when it comes to something as important as managing debt, people want to work with experts they can trust!

For example, instead of just writing a blog post about a specific aspect of debt settlement, you could create a comprehensive guide that covers everything someone needs to know. This kind of pillar content might include topics such as “Understanding Debt Settlement: A Comprehensive Guide” or “The Benefits and Risks of Debt Settlement”.

By providing valuable information on these topics, you position your business as an expert in the field of debt settlement. As a result, this can help you stand out from your competitors and attract potential customers who are looking for reliable information on debt settlement.

Read More: The Ultimate Guide to Pillar Content Strategy for Business Owners

Pillar Content Marketing vs. Debt Settlement Live Transfer

When it comes to generating leads for your debt settlement business, you can employ various marketing strategies. Two of the most popular ones are pillar content marketing and debt settlement live transfers. In this blog, we will compare and contrast the two approaches, highlight their benefits and drawbacks, and explore how you can combine them for maximum results.

Pillar Content Marketing

Pillar content marketing involves creating high-quality, informative, and engaging content that covers a broad topic area. This content is usually in the form of long-form articles, videos, or infographics. Here are some of the benefits and drawbacks of this approach:

Benefits:

- Builds authority and credibility: By providing valuable information to your target audience, you position your business as an expert in the field of debt settlement.

- Drives traffic and engagement: Quality content is more likely to be shared and linked to, driving more traffic to your website and increasing engagement with your brand.

- Long-term results: Pillar content is evergreen, meaning it stays relevant and valuable for a long time, generating leads for your business in the long run.

Drawbacks:

- Requires time and effort: Creating high-quality pillar content takes time and effort, as it involves in-depth research and planning.

- May not produce immediate results: It may take some time for your content to gain traction and generate leads for your business.

Debt Settlement Live Transfers:

Debt settlement live transfers involve purchasing leads from third-party companies that specialize in generating leads for debt settlement businesses. Here are some of the benefits and drawbacks of this approach:

Benefits:

- Immediate results: Live transfers deliver leads to your business in real-time, allowing you to follow up with potential customers right away.

- Saves time and effort: Instead of spending time and resources on lead generation, you can focus on closing deals and servicing your clients.

- Highly targeted: Live transfers are typically highly targeted, meaning you only receive leads that meet specific criteria.

Drawbacks:

- Expensive: Purchasing live transfers can be costly, especially if you require a high volume of leads.

- Lower quality leads: Since live transfers are purchased from third-party companies, the quality of leads can vary, leading to lower conversion rates.

Combining the Two Strategies:

You can maximize your lead generation efforts by combining pillar content marketing and debt settlement live transfers. Here’s how:

- Use pillar content marketing to attract and engage your target audience, driving traffic to your website.

- Implement lead capture forms on your website to collect contact information from potential customers.

- Purchase debt settlement live transfers that match the criteria of your ideal customer profile.

- Follow up with potential customers immediately and provide them with value-added information to build trust and credibility.

In conclusion, pillar content marketing and debt settlement live transfers have benefits and drawbacks. By understanding the strengths and weaknesses of each approach and combining them strategically, you can generate a steady stream of high-quality leads for your debt settlement business.

You May Also Like: Pillar Content vs. Cluster Content: Content Strategy Success

How to Create Effective Pillar Content

If you’re running a debt settlement business, one of the most crucial aspects of your business is generating high-quality leads. Fortunately, one effective way to generate leads is through pillar content marketing. Here are some tips on how to create effective pillar content that resonates with your target audience and drives engagement and shareability.

1. Identify Topics That Will Resonate With Your Target Audience

The first step in creating effective pillar content is identifying topics that your target audience cares about. Put yourself in your audience’s shoes and think about their pain points and questions.

What kind of information do they need to make informed decisions about debt settlement? Once you’ve identified these topics, you can start creating content that provides value and meets their needs.

2. Structure Your Content For Maximum Engagement and Shareability

Once you’ve identified your topic, it’s time to structure your content to maximize engagement and shareability. Here are some tips to keep in mind:

- Use a catchy headline that grabs your audience’s attention.

- Break up your content into easy-to-read sections with subheadings.

- Use visuals like images and videos to break up the text and make your content more engaging.

- Use bullet points and numbered lists to make your content more scannable.

- Use social sharing buttons to encourage readers to share your content on social media.

3. Examples of Successful Pillar Content in the Debt Settlement Industry

To give you an idea of what successful pillar content in the debt settlement industry looks like, here are some examples:

- “10 Unsecured Debt Settlement Mistakes to Avoid” – This article provides valuable information about common debt settlement mistakes and how to avoid them.

- “How to Negotiate Debt Settlement on Your Own” – This article provides a step-by-step guide on how to negotiate debt settlement without hiring a debt settlement company.

- “The Pros and Cons of Debt Settlement” – This article provides an overview of the pros and cons of debt settlement to help readers make informed decisions.

Creating effective pillar content is essential to generating high-quality leads for your debt settlement business. By identifying topics that resonate with your target audience, structuring your content for maximum engagement and shareability, and providing valuable information, you can establish yourself as an expert in the field and drive more traffic to your website.

Read More: 5 Best On-Page SEO Tools in 2023

Promoting Your Pillar Content

If you want your business to grow and succeed, you need to generate leads. And creating high-quality pillar content is one of the best ways to do that! But wait, there’s more! It’s not enough to create content alone. You also need to promote it effectively. So, let’s explore some fun and engaging strategies for promoting your content and attracting new leads to your business!

Using Social Media and Other Channels to Amplify Your Message:

Social media is where it’s at! With billions of people using social media platforms, it’s an excellent way to reach a broad audience and amplify your message. But don’t stop there! Email marketing, paid advertising, and influencer outreach are other channels you can use to promote your content.

The key is to identify the most effective channels for your business and target your audience where they are most active.

Creating a Content Promotion Plan

Having a plan is key! Here are some tips for creating a content promotion plan that works for your business:

- Know your target audience: You need to know who you’re talking to if you want your content to resonate with them. Identify your ideal customers’ demographics, interests, and pain points, and tailor your content and promotion strategy accordingly.

- Set clear goals: What do you want to achieve with your content promotion? More website traffic, leads, or conversions? Whatever your goals, make sure they are specific, measurable, and achievable.

- Create a content calendar: This helps you plan and organize your content promotion activities. It ensures you have a consistent flow of content and allows you to schedule promotions in advance.

- Use data to guide your strategy: Analyze your content performance and engagement metrics to identify what’s working and what’s not. Use this information to adjust your strategy and optimize your promotion efforts.

- Collaborate with others: Working with other businesses and influencers can help you reach a broader audience and build credibility. Identify potential partners who share your target audience and values, and create mutually beneficial partnerships.

Read More: How to Make a Content Calendar in 6 Easy Steps

Measuring success

We all know how important it is to have a constant flow of leads, right? That’s why pillar content marketing is a great way to generate them. But how can you tell if your campaign is working? Don’t worry, we’ve got you covered! In here, we’ll talk about how to measure the success of your pillar content marketing campaign and offer some tips on adjusting your strategy based on your results.

Metrics to Measure Success

To measure the success of your pillar content marketing campaign, you need to track a few metrics. These include website traffic, social media engagement, and lead conversion rates.

Website traffic lets you know how many people are visiting your site and consuming your content. Social media engagement measures how much your content resonates with your target audience. And lead conversion rates tell you how many visitors become leads.

The Importance of Long-Form Content for Social Media Engagement

Social media is a fantastic way to promote your pillar content, but did you know that long-form content performs better than short-form content on these platforms?

That’s because long-form content provides more value to your audience and encourages them to spend more time on your website, leading to higher engagement and more leads. So, don’t be afraid to go long!

Adjusting Your Strategy Based on Results

Once you’ve measured your success, it’s time to adjust your strategy. If your website traffic is low, re-evaluate your content strategy and make sure you’re providing value to your target audience.

If your social media engagement is low, try experimenting with different types of content or posting at different times of the day. Finally, if your lead conversion rates are low, tweak your lead capture forms or provide more targeted calls-to-action.

Measuring the success of your pillar content marketing campaign is crucial to generate debt settlement leads. So, make sure you keep an eye on your website traffic, social media engagement, and lead conversion rates. And remember, long-form content is your friend when it comes to social media engagement. Keep these tips in mind, and your lead generation efforts will be soaring in no time!

Read More: The Types of Marketing For Your Brand (2023)

Final Thoughts

Generating debt settlement leads is crucial for the success of your business, and pillar content marketing is a powerful strategy to achieve this goal. By measuring the success of your campaign and adjusting your strategy based on your results, you can maximize your lead generation efforts and attract high-quality leads to your business.

Get in touch with Lead Advisors for more quality debt consolidation leads for sale. We ensure that you get the correct type of leads to help you deal with your business requirements. Our lead generation process is updated with cutting-edge technology so that you don’t get unwanted bulk leads. Get in touch with Lead Advisors to lead your business in the right direction.

Updated: April 26, 2023